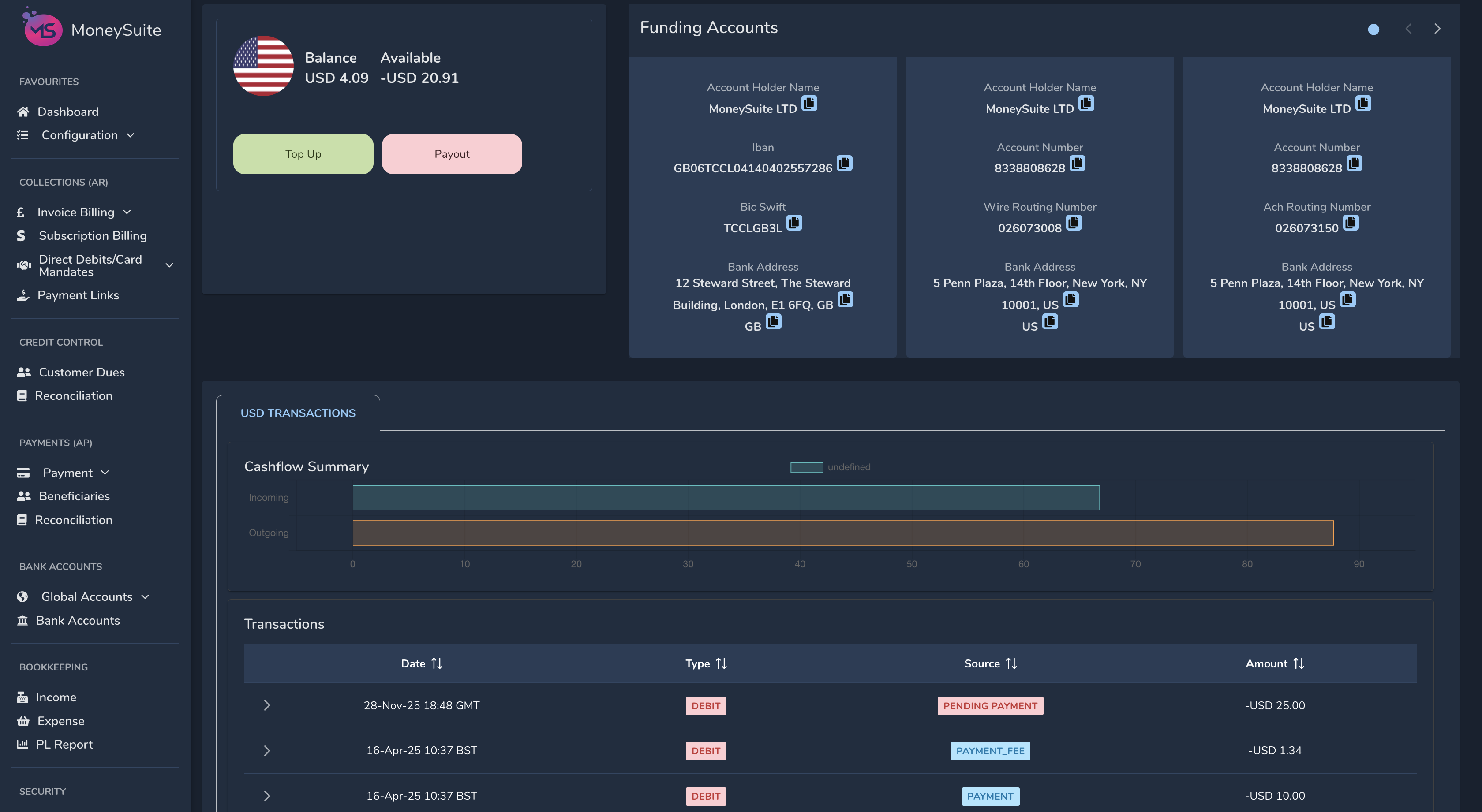

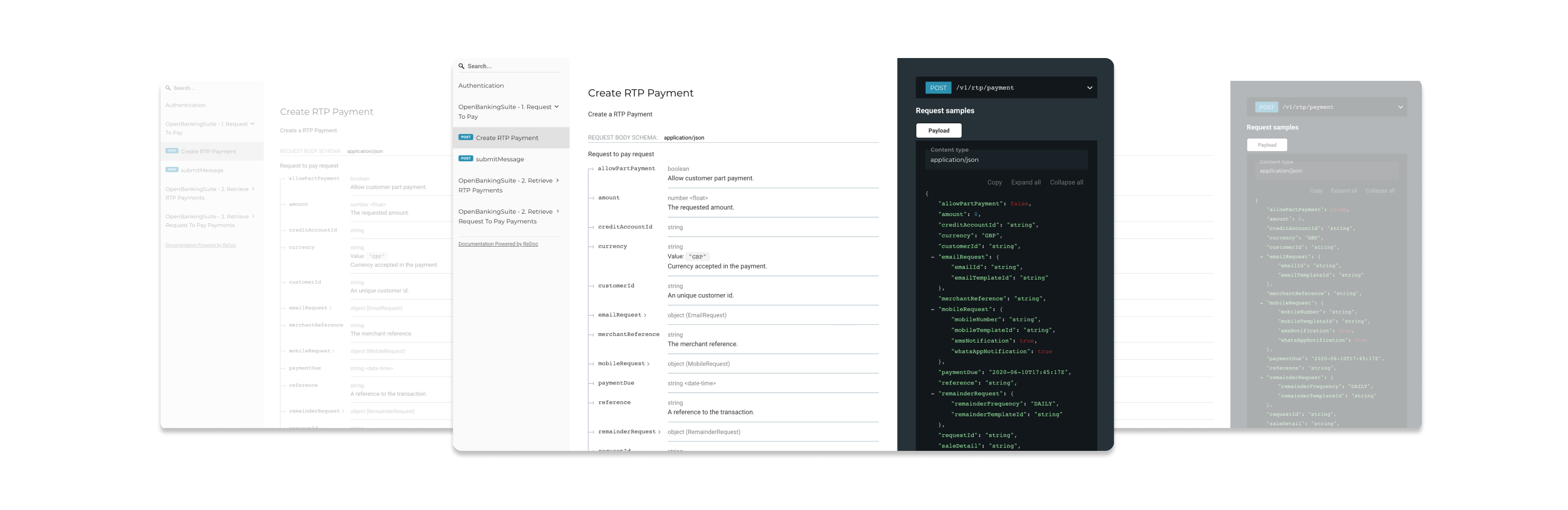

Automate

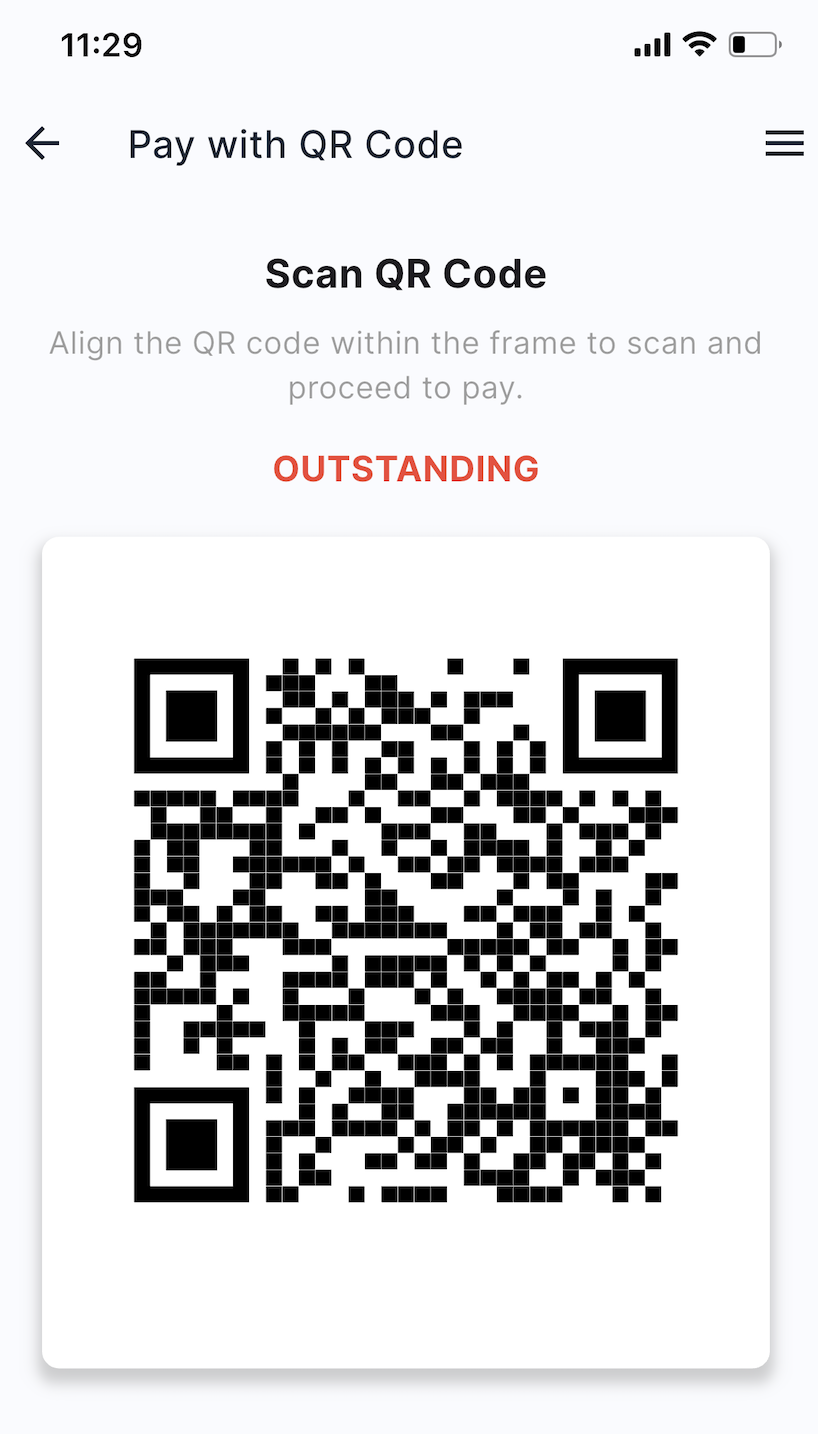

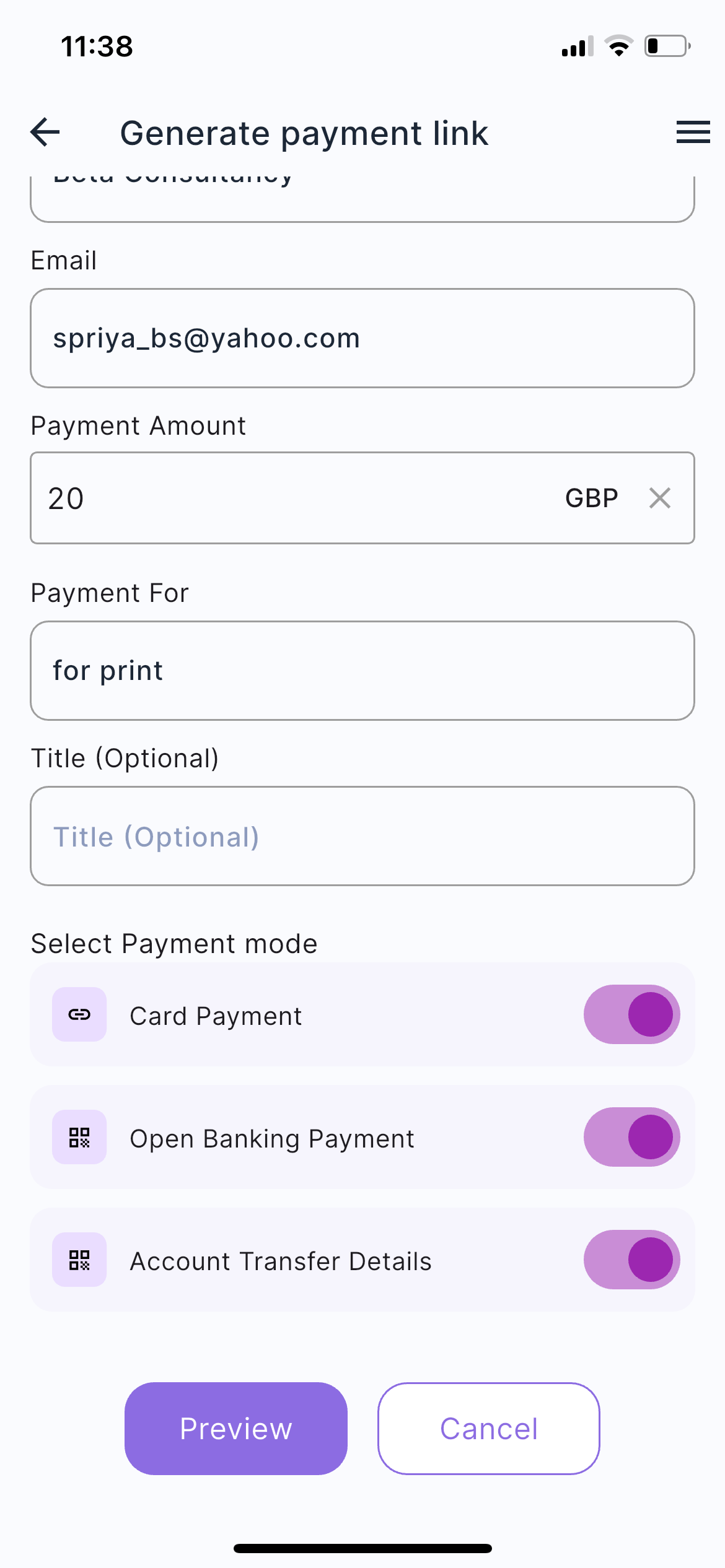

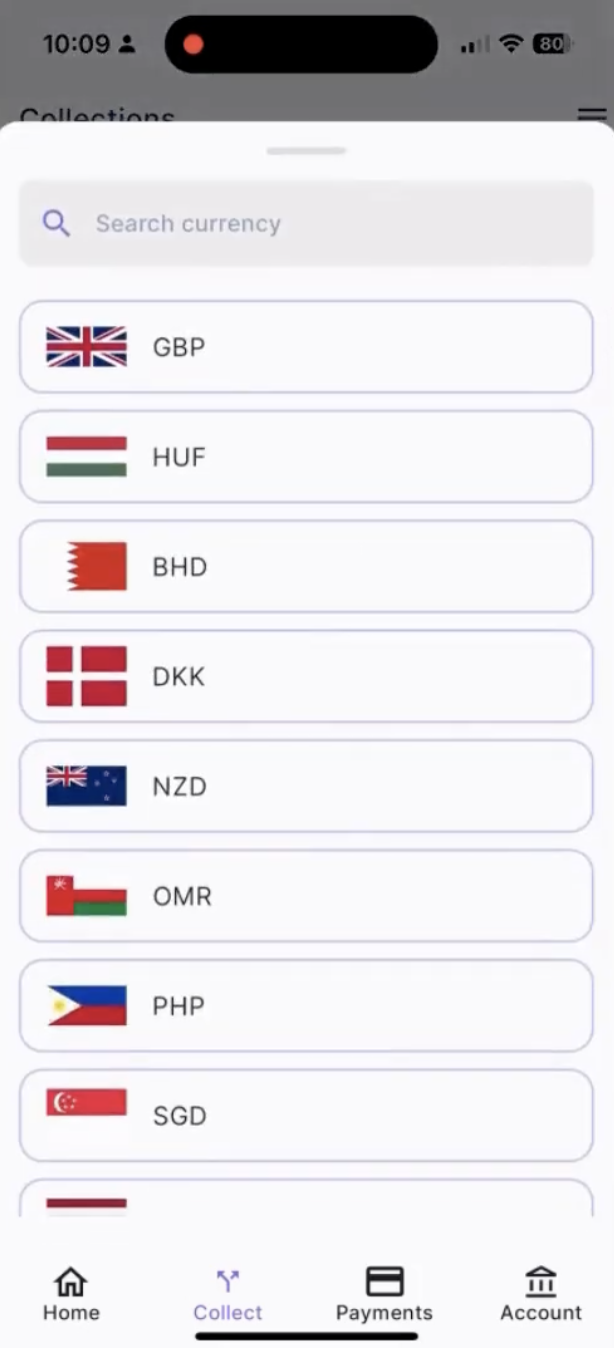

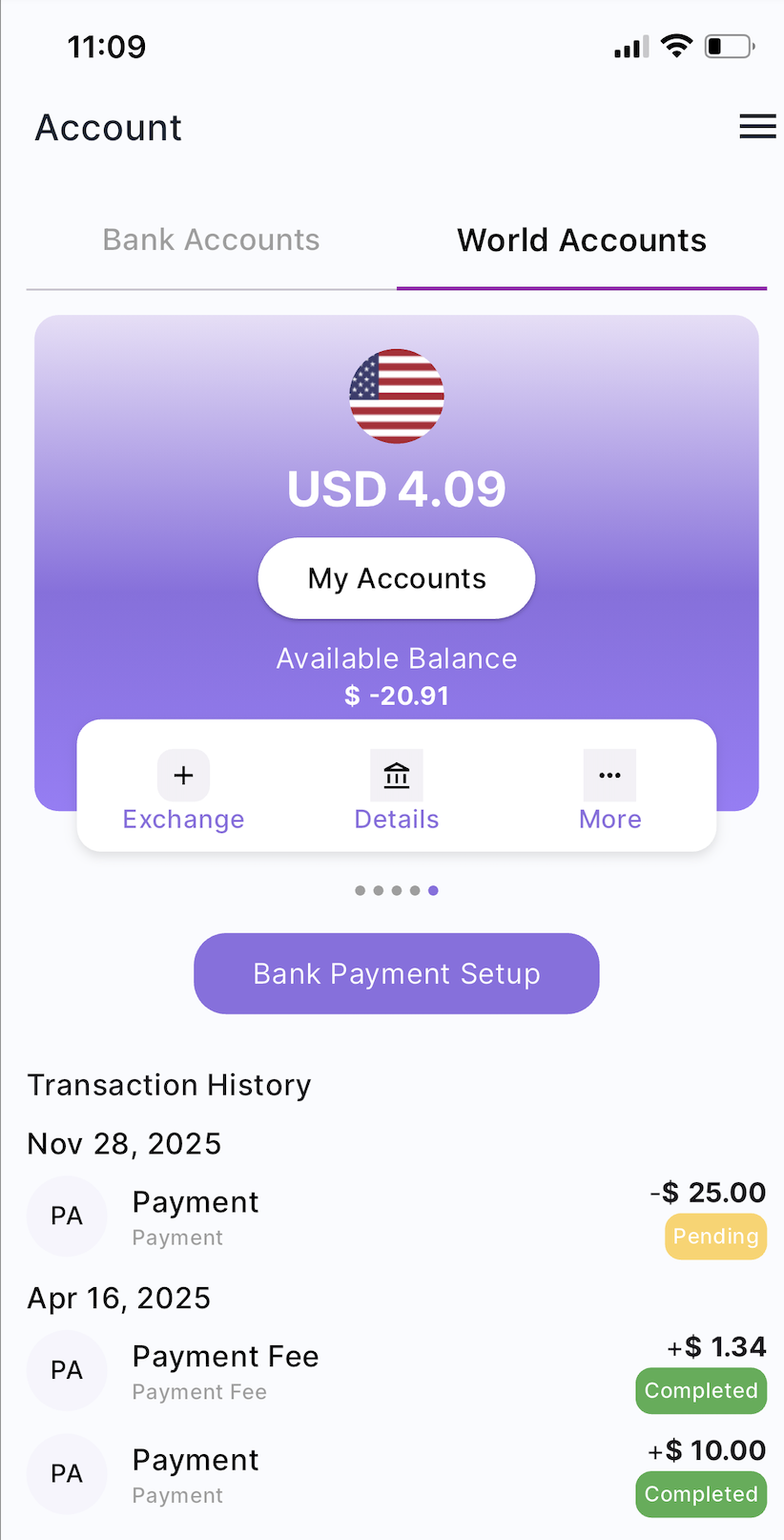

Collections & Payments

Save cash. Save time

Collect and pay effortlessly across the globe with automated credit control, bookkeeping, and bill payments—saving time and costs while helping you grow your business.